PERSONAL BANKING

Financial Health Assessment Breakdown

Here’s how to make sense of your test results

Just like you visit your doctor for regular checkups and recommendations for healthier living, your Financial Health Assessment can provide the same, but for your financial situation.

Like your physical health, achieving financial wellness is a long-term commitment rather than something that happens overnight. If you’re setting big financial goals, then small shifts in behavior and commitment over a long period can help you get there.

How the Financial Health Assessment Works

The Financial Health Assessment provides a simple score to reflect the state of your finances. It considers factors such as how much you have in savings and retirement plans, and your income versus spending.

Here’s the good news: You’ve already done the most challenging part of any process — getting started! Knowing where you stand is a great first step to improving financial health. And if you scored lower than where you want to be, then rest assured there isn’t a score so low that you can’t improve dramatically.

Now, let’s discuss what your score means and tips to improve or keep good behaviors going.

Breaking Down Your Score

To determine your score, we ask you the following eight questions:

- Do you spend less than your income?

- Do you pay bills on time and in full?

- Are your living expenses sufficient?

- Do you have long-term savings?

- Is your debt load sustainable?

- Do you have a good credit score?

- Are you covered by the appropriate insurance?

- Do you plan ahead for expenses?

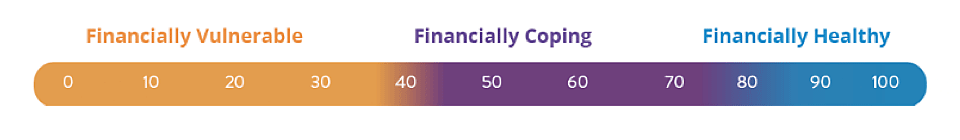

Based on your answers, you’ll receive scores ranging from 0 to 100. Then, we take the average of your scores from each question to determine your final score. That number gives us a solid impression of your overall financial health, which you can use to create a plan of action.

For our assessment, your score can fall into one of three categories:

Financially Vulnerable, Financially Coping, or Financially Healthy.

Here’s a breakdown of what each category means, accompanied by practical tips to improve, or maintain healthy financial behaviors.

Financially vulnerable: The struggle is real

What does this mean: If you scored between 0-39, then you are considered “Financially Vulnerable.”

This could mean a number of things: Perhaps your spending currently outweighs your income, or you’re struggling to build savings. Or maybe your credit score isn’t quite where you want it.

No matter the concern, there are immediate steps you can take to better your financial health.

Steps to improve

Here are some general tips to help get you on your path to financial wellness. Take what works for you and leave the rest.

Spend less

- Check all your monthly subscriptions and trim anything unnecessary.

- Contact cable, internet, cell phone, and insurance providers and ask if they have a better deal (you might be surprised).

- Track all spending for a month and note areas where you could cut costs.

Generate extra income

- Research how to start a side-hustle, if you have specific skills or knowledge on a variety of services or topics.

- Sell unwanted items on a marketplace app.

- Improve your job skills, then leverage your new knowledge to ask for a raise. You can also work to improve your resume or interview skills.

Tackle debt

- Research the “snowball” or “avalanche” debt-payment methods and commit to one.

- Set up automatic bill pay to avoid missed or late payments, which could hurt your credit score.

Plan for the future

- Shop for the best insurance for your needs, such as renters, homeowners, and auto.

- Start a rainy day fund for unexpected expenses — even if you start with a few dollars per month.

- Leverage the budgeting tools and savings goals in your Digital Banking app and begin tracking everything. Understanding where your money is going can help you make financial decisions moving forward.

Remember: Small steps today compound over time.

Financially coping: Surviving, not thriving

What does this mean: If you scored between 40-79, you are in the category of “Financially Coping.”

Maybe your spending is nearly the same as your income. Or perhaps you feel you’re making progress, but an unexpected expense can set you back.

While you’re on the right track, small changes to your behavior could completely change your relationship with money.

Steps to improve

If you haven’t mastered the tips in the “Vulnerable” category, that’s a great place to start. Then, you can take your financial wellness to the next level with these actionable steps:

- Pay credit cards off in full every month. This will boost your credit score and cut down on interest costs.

- Work toward a healthy emergency fund. Aim for a minimum of three to six months’ worth of living expenses. Then, start thinking about other longer-term savings goals.

- Read books about personal finance to improve your overall knowledge on saving, investing, and budgeting.

- Plan for the long-term. If you don’t already have one, consider opening a retirement savings account, such as an individual retirement account (IRA) or a 401(k), if offered by your employer.

Do these steps, and you’ll be well on your way to better financial health.

Financially healthy: All-star status

What does this mean: If your score is between 80-100, then you are in the “Financially Healthy” category.

Congratulations! You likely have sufficient savings, a good credit score, and spend less than you make.

Steps to improve

Keep doing what you’re doing. You’ve been diligent about your financial health, and it shows.

If you want to confirm all the reasons why you’re on the right track, then check out the advice for the “Vulnerable” and “Coping” scores. Make sure you understand what you’ve done well, so you can continue to do it in the future.

No matter what your score was

Now that you know where you stand, you can take small steps to start or continue on your path to financial wellness.

Financial health comes about when your daily financial systems allow you to be resilient and pursue opportunities over time.

©2022, MainStreet Bank. All rights reserved.